This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognizing you when you return to our website and helping our team to understand which sections of the website are the most popular and useful.

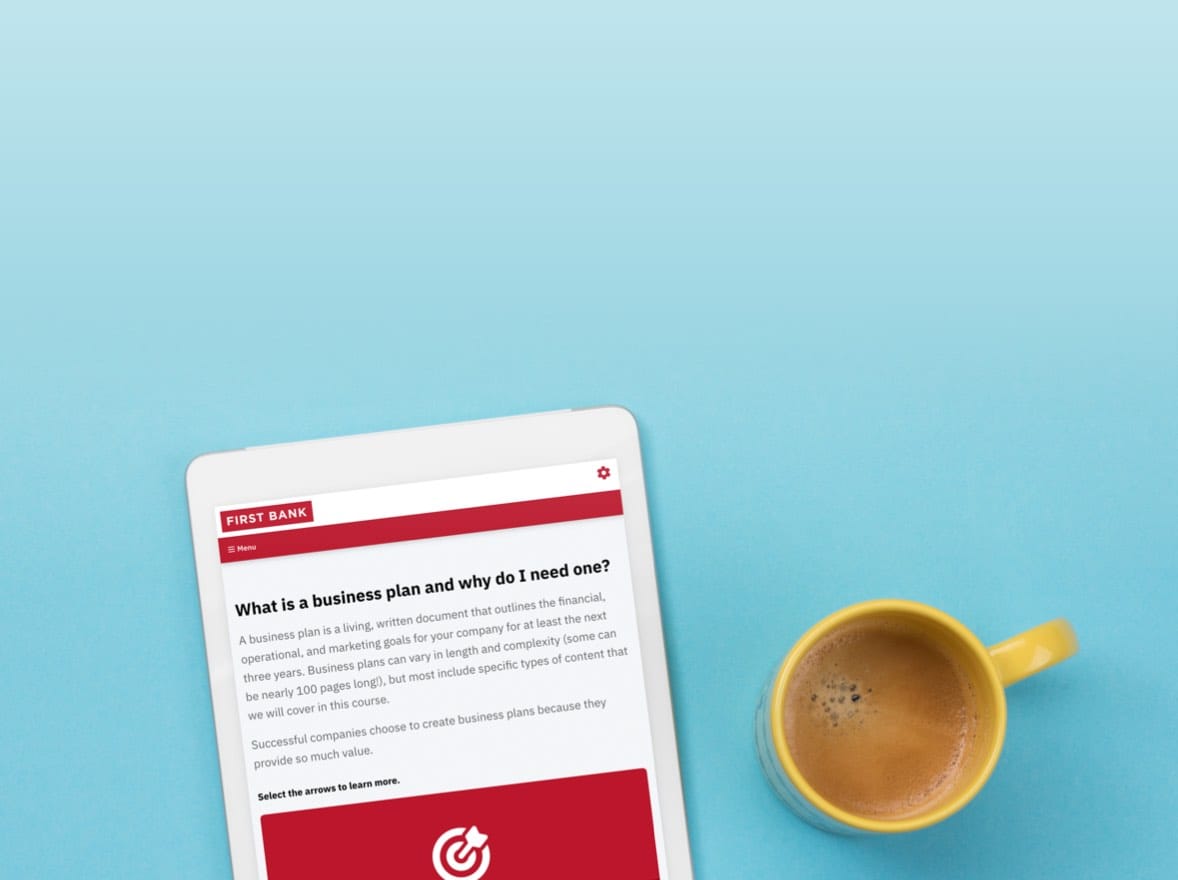

When you need funding to fuel your small business, First Bank is ready to help.

Our team helps entrepreneurs like you pursue their dreams with hassle-free access to government-sponsored loans from the Small Business Administration (SBA).

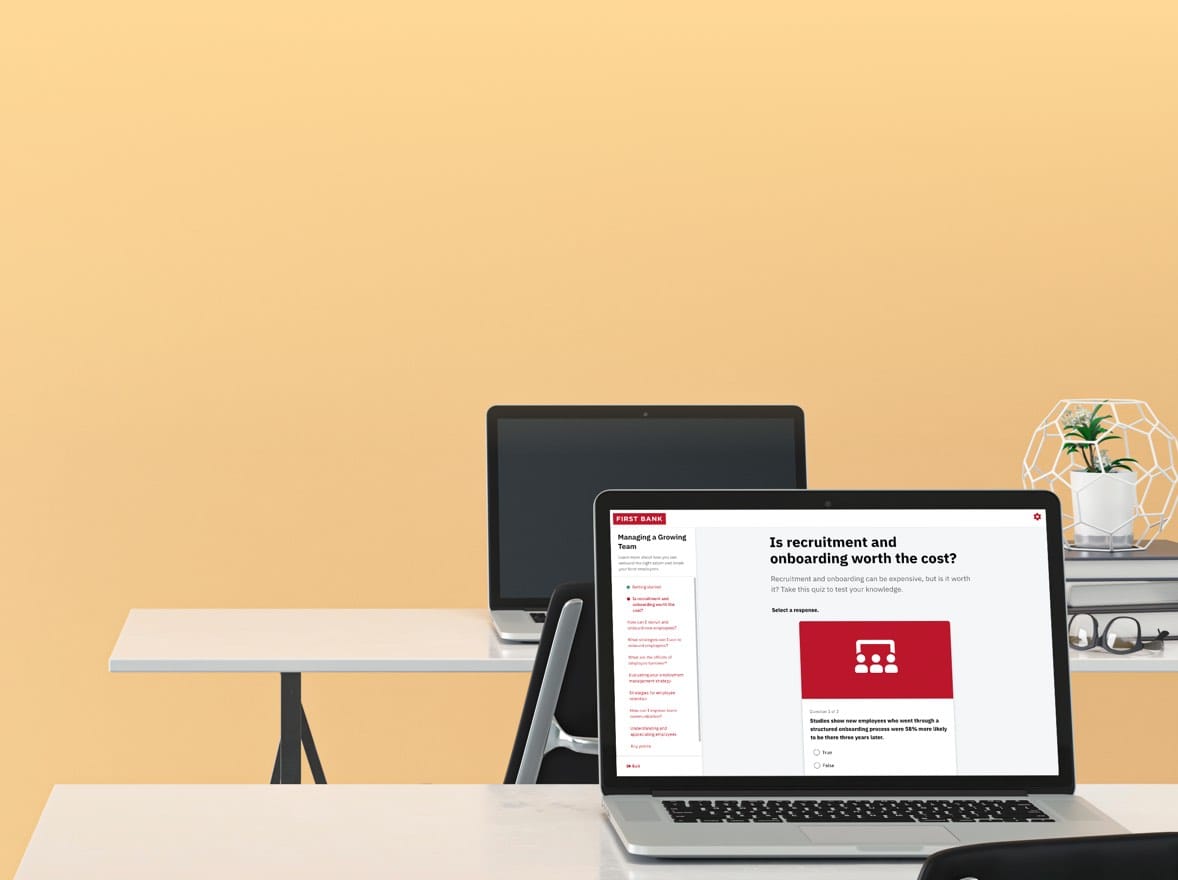

- You need flexible funding options to acquire or expand a business

- You want competitive terms for a partnership buyout or succession planning

- You’re buying commercial real estate or consolidating debt

We offer different types of SBA loans to meet the unique needs of your growing business.

The SBA Lending Process

A simple process to get the right loan for your business.

Ready to get started?

Approved to offer SBA loan products under SBA’s Preferred Lender programs. Loans subject to credit approval.